Bosch Remains a Leader In OEM Parts Supply Worldwide

Some of the top suppliers of auto parts in Europe have seen downward trend in revenue over the last year, but Robert Bosch has been a noteworthy exception. The company’s Mobility Solutions subsidiary, which is actively involved in production of automobile elements (powertrain solutions, chassis, electrical drives, battery technologies, etc.), made a large part of company's revenue (60%) in 2018, 0.4 % growth in sales to € 47.6 bln. The subsidiary’s profit margin of 7.1% declined by 0.2% compared to the year before, but earnings grew to €3.53 bln (+€ 0.18 bln compared to 2017).

Top 10 global OEM parts suppliers ranked by sales of original equipment parts in 2018

This pretty solid financial result was achieved in the face of decrease in production cars, strain in trading relations between superpowers, car sales drop in China, confusion around Brexit and strengthening of the emissions control. Despite numerous negative economic factors, which affected the automobile industry in 2018, Bosch managed to achieve good results in realization of its products. At the same time, the main Bosch competitors have nothing to boast about: operating profits of Continental, ZF, and Schaeffler declined by 12- 13 %. Auto business analysts note that Bosch found a perfect balance between production optimization and investments in future projects.

![]()

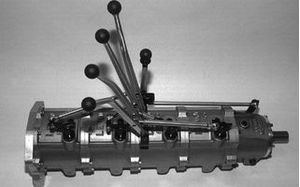

Bosch auto parts

Bosch officials assume that the company managed

to maintain its leadership in supply of automobile components under harsh

economic conditions thanks to a number of popular product ranges such as

solutions for exhaust gas treatment, transmissions and driver assistance

systems. The company concentrated on its products and paid close attention to

customer needs without becoming too dependent on particular carmakers. Bosch manifested

the capacity to adjust to unfavorable conditions on the market.

As the electrification, self-driving technologies gain momentum in the auto business, Bosch, like its main competitors, is looking for ways to establish itself as a leader in this promising niche. Despite the fact that real profits in those areas may not come in a short-time horizon, Bosch sets some goals and invests in R&D of future innovations. It should be noted that Bosch capitalized only a small part of R&D expenditures. This comparatively low rate reflects the fact that Bosch invested significant financial resources in future products that may not hit the market in the nearest future and won’t give any profit.

Despite negative predictions on vehicle production rates and global GDP, Bosch still set the goal to achieve approximately 7% profit on sales. To achieve this objective, Bosch will seriously count on new tech solutions. Capital expenses are dedicated to electrification technologies, automated driving and a new chip factory in Germany. The company does its best to progress faster than auto makers. In the field of exhaust gas treatment Bosch plans to achieve € 3 bln sales mark by 2025. The company also works hard in the area in automated driving and assistance systems. Bosch officials assume that sales of radar sensors alone will increase by 20% this year, and those of video sensors – by 30%. Sales related to electrification are predicted to reach € 5 bln in six years.