CVT Issues Make Things Worse for Nissan on the American Market

Recently, Nissan has reduced its annual earnings expectations to its lowest level over the past 10 years caused by weakening of its positions on the US market, partially due to quality issues with its transmissions.The Japanese carmaker predicts operating earnings to drop 45 % versus a year earlier to $2.84 bln, because of costs related to extensions of car warranties in the US, its biggest market.

Meanwhile, Nissan's majority shareholder, Renault

SA of France (43.3%), not long ago presented a proposal for a new ownership

agreement, within the framework of which it is planned to merger companies into

a holding company. Nissan, in turn, turned the offer down.

Nissan also put the blame on all the publicity

surrounding the controversial case of former Ch

airman Ghosn for harming the

brand reputation and stimulating the drop in sales. Financial difficulties have

been haunting Nissan after Ghosn’s arrest last year on the charge of financial

fraud. Due to negative media coverage of the case, customers hold off on buying

Nissan cars, so in the past several months the sales fell. Ghosn, who denies

all wrongdoing, has been recently released on bail for $4.5 million. He faces

up to 15 years in prison if found guilty.

Carlos Ghosh

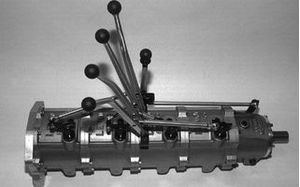

But Nissan's more pressing issue is related to CVT transmissions installed in its cars. The automaker allocated $590.5 million to prolong warranty commitments on CVTs applied in specific models for the US market. This measure will include more than three million cars sold within the period from 2012 to 2017, including the Sentra, Versa, and Altima. According to numerous complaints, with time the crucial powertrain element causes inconveniences to the car owners with excessive noise and vibrations. Therefore, Nissan came up with the idea to prolong their warranty obligations to 7 years from 5 in an effort to strengthen customer loyalty in a highly- competitive American market where the company has been experiencing hard times over the recent years.

The most negative impact, however, to Nissan’s balance between revenue and expenditure flows has come from the improper sales policy in the US. For a long time, the company has been providing unreasonable discounts to ensure competitive gains in selling its new models and to expand its share on the US market.

Hiroto Saikawa

Hiroto Saikawa, who took the CEO position two

years ago, has promised to take meaningful steps on improving the financial

situation, but it has been not very efficient so far, as Nissan keeps returning

to the policy of increased discounts to support sales.

Disappearing Gap Between Renault and Nissan

profits

Analysts assume that Nissan’s financial difficulties may negatively affect its position in relations with Renault, which has been aiming for a closer merger, which is currently opposed by Nissan. To avoid closer ties with Renault, the Japanese automaker must efficiently address its financial challenges, so it can hold its position. Nissan shares dropped in price by 4% after the profit predictions, while Renault shares fell as much as 5.5 %.