Decade of Growth for Auto Parts Industry May Soon be Over

Companies specialized in production, supply and selling of automobile parts have been enjoying a decade of consistent growth, but analytical experts assume that a wide range of negative trends such as the downturn of car sales, increasing prices for raw materials and significant expenditures on Research & Development give little ground for optimistic predictions.

The collection of ambiguities and doubts in

regard to leading technologies of the future, unsettled issues with import

tariffs and numerous disagreements between major countries (especially US and

China) will have a negative impact on financial statuses of numerous auto parts

manufacturers and suppliers, reducing their investment capacities.

The auto business is already the in

transitional period, reducing payment records in expectation of possible

financial instabilities. According to one survey, sector reduced the number of

jobs almost by 22,000 in the U.S. during the first 5 months of 2019, or 211%

more than during the same period last year.

Neal Ganguli, the head of the auto supply base

group for Deloitte, assumes that business approaches and strategies will play a

major role in determining winners and losers in the future.

Mr. Ganguli is convinced that past achievements

won’t ensure a bright future. The industry itself will continue growing, but the

supply base is also assumed to undergo significant changes. Thus, if the cost

of auto components per car is going to rise, it does not necessarily guarantee

prosperity for all the parties involved in the business.

Moreover, Ganguli thinks that all financial

achievements of the industry over recent years have been a bit deceitful. Since

the time of Great Recession, car suppliers have accumulated approximately $510

bln in shareholder value, nearly doubling this parameter compared to the

pre-Recession time.

But the thing is that the growth rate was not

equally allocated. The top third of suppliers enjoyed more than 99% of this

growth. It is assumed that negative trends in the auto

industry will force suppliers to consolidate with other businesses or find the

way to diversify their product lines.

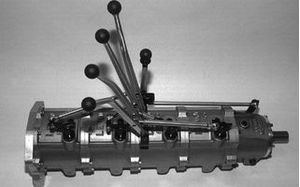

The consolidation process can be specified by long-term perspectives on directions of the market development. According to the study, such areas of the auto business as gearboxes and axles production are predicted to drop 6 to 10%, respectively, by 2025. At the same time, new types of vehicles (electric and self-driving) are assumed to rise. According to Deloitte, electric drivetrain technologies are to boost by 306 %, battery and fuel cell segments by 266 % and cutting-edge driver-assistance systems and sensors by 190 %.

The influx of capital in these segments are predicted to be spurred because of sinking car sales, as suppliers want to ensure more stability in a fluctuating market. Slowdown tendencies in the rates of economic growth will accelerate consolidation processes, resulting in more divesting or acquiring.