ZF Cuts Profit Outlook on Auto Sector Slowdown

In the first half of 2019, ZF’s sales

performance reached around €18.4 bln, while the operating earnings run at

approximately €650 mln. On the basis of current financial situation in the

company and unfavorable economic situation in the automobile industry, ZF had

to lower its sales and earnings predictions for 2019. Financial analysts of the

company expect that the sales volume in the 2-nd half of the year will range

between €36 - €37 bln and adjusted EBIT margin between 4-5% for the year.

According to ZF’s CEO Wolf-Henning Scheider,

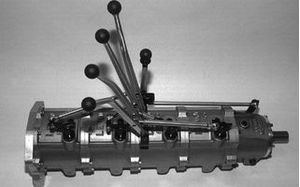

the company has recently received 3 major orders (2 from BMW and FCA for the

latest hybrid automatic 8HP gearbox and 1 from Daimler for major powertrain

elements for the latest electric drive SUV Mercedes EQC). It shows that the

company’s efforts focused on introduction of new environmentally-friendly

technologies match expectations of potential customers.

But at the same time, Mr. Scheider pointed out

that ZF is not immune from the unstable economic circumstances in the industry,

which manifests itself worldwide, therefore the company has to adjust its

economic forecasts in accordance with deteriorating situations on the

automobile market.

Despite the fact that the segment of heavy-duty

trucks and the industrial vehicles initially remained quite enduring, ZF’s

sales became worse in the first half of this year because of the slump in sales

at the main market, especially in China. Previously, ZF expected a bit more

positive results in sales turnover. In addition to the economic downfall in the

industry, there are several political causes that have a negative impact on

financial results of automakers and manufacturers of automobile components: unclear

situation around Brexit and trade wars between China and the US, and associated

currency fluctuation. As a consequence, the company sales dropped by 1.7 % to

€18.4 bln.

ZF sales in the 1-st

half of 2019 by regions and by divisions

ZF’s adjusted EBIT rate of €646 mln fell short

compared to the predicted range in the 1-st half of this year. The main

incentives for such statistics turned out to be the abovementioned plummeting

car sales, significant investment in R&D operations and opening of new

facilities.

Despite the fact that the officials of the company is not happy with these numbers, ZF won’t give up its investment projects related to the technologies of the future (E-mobility and self-driving technologies). The company plans to adjust its capacities and to put on hold or decrease financial support in established areas where the economic slowdown is apparent. Moreover, the company has to consider the upcoming expenditures related with the acquisition of WABCO. For this purpose, ZF considers issuing a bonded loan and a Eurobond.

It is very unlikely that the global economy will go through any progress in 2019, thus ZF had to lower its financial expectations for 2019. The sales estimations for this year were based on the conditions of stiff markets and invariable rates of exchange.