ZF Issues Bonded Loans of € 2.1 bln to Acquire Wabco

ZF has issued a total bond-secured loan of € 2.1 bln. According to ZF, one of the main objectives of this measure is to ensure the gap financing of the scheduled takeover of Wabco, a leading manufacturer of security and control solutions for CVs. The final sum of the loans will be provided via several tranches with repayment periods (3-10 years).

Learn more about Wabco

from its corporate movie

Initially, the company was hoping to get away

with

€ 500 mln in bond-secured loans. But

because of a significant oversubscription - even in fluctuating market

conditions- ZF decided to enhance the sum and in doing so issued the 2-nd biggest

bonded loan in its history at favorable market prices.

According to released official information, ZF has managed to achieve an impressive order volume for this deal. This major deal attracted attention not only from potential local investors, but also from foreign financial companies. It can be said that the great interest from international investors is a vivid evidence of high degree of trust in ZF’s financial structure, reasonableness of the takeover deal, and prospects of the company in the fast-growing automotive industry.

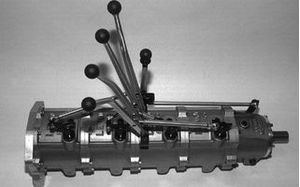

ZF and Wabco had a proven record of joint projects before the takeover deal

The abovementioned financial operation was supported by several German banks. Afterwards, ZF is considering the possibility of issuing Euro-bonds aiming to replace the residual sum of gap financing for the Wabco acquisition. It should be recalled that the takeover deal is estimated at $7 bln.